Compare accounts

Get guidance

Compare accounts

Get guidance

Money market accounts

Money market accounts are similar to savings accounts, but offer some checking features as well.

Get guidance

Banking

Skip the searching and find your next bank in minutes with BankMatch℠.

Get guidance

Compare rates

Get guidance

Compare rates

Get guidance

Buying & selling

Find an expert who knows the market. Compare trusted real estate agents all in one place.

Get guidance

Compare investments

Get guidance

Compare plans

Get guidance

Finding an advisor

Get guidance

Compare cards

Find your fit

See your card matches

Answer a few quick questions and we’ll show you your top credit card options.

Compare cards

See what the experts say

Read in-depth credit card reviews to find out which cards have the best perks and more.

Get guidance

Get advice

Build credit

Compare lenders

Get guidance

Compare lenders

Get guidance

Compare lenders

Get guidance

Compare lenders

Get guidance

HELOC

A HELOC is a variable-rate line of credit that lets you borrow funds for a set period and repay them later.

Home equity basics

Home equity loans

Home equity loans let you borrow a lump sum at a fixed rate, based on how much of the home you own outright.

Get guidance

Compare rates

Get guidance

Compare rates

Get guidance

Compare companies

Get guidance

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free – so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. Presently, she is the senior investing editor at Bankrate, leading the team’s coverage of all things investments and retirement. Prior to this, Mercedes served as a senior editor at NextAdvisor.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here’s an explanation for .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money.

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Treating America’s obesity epidemic is turning into big business. Two pharmaceutical companies, Eli Lilly (LLY) and Novo Nordisk (NVO), are leading the weight-loss revolution with a new class of drugs known as GLP-1 agonists.

Surging revenue and growing excitement has led some analysts to compare the success of GLP-1 drugs in the health and wellness market to the artificial intelligence boom in the tech industry.

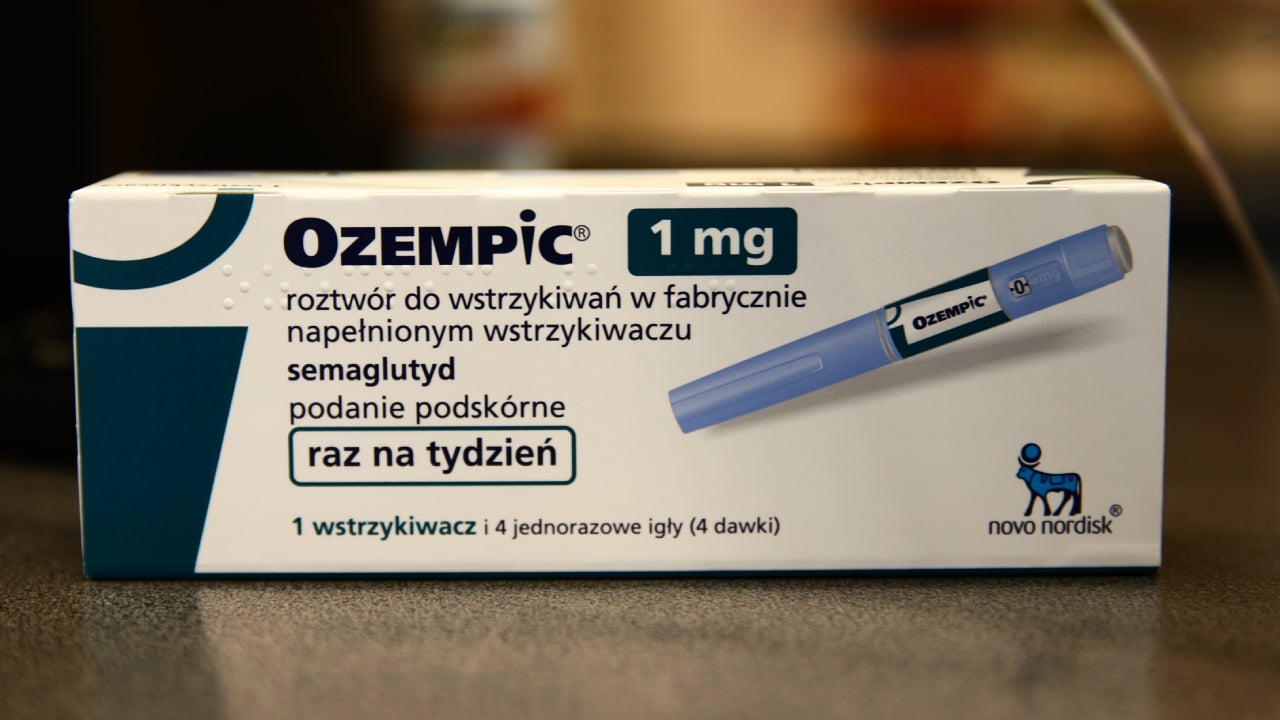

Drugs like Ozempic from Novo Nordisk and Zepbound from Eli Lilly have taken the market by storm, not only for their effectiveness in weight management but also for the significant boost they’ve given to company stock prices.

The boom is fueled by a class of drugs known as GLP-1 agonists. GLP-1 is a naturally occurring hormone in the body that is produced after you eat, helping your body manage blood sugar, regulate insulin and curb hunger while slowing down digestion. GLP-1 agonists bind to GLP-1 receptors in the body, mimicking the effects of the hormone.

The first GLP-1 drug was Byetta (exenatide), approved in 2005 for type 2 diabetes. Almost five years later, Novo Nordisk introduced Victoza (liraglutide), another diabetes drug based on human GLP-1. In 2014, liraglutide became the first GLP-1 medication approved for weight management in the U.S.

However, the real turning point came about two years ago when Novo Nordisk’s semaglutide (marketed as Ozempic for diabetes and Wegovy for weight loss) revolutionized the field. Unlike its predecessors, semaglutide required only weekly injections, instead of daily or twice-daily dosing.

Unlike many other weight-loss medications, GLP-1s have shown consistent positive results in clinical trials. The lack of readily available and effective weight-loss alternatives makes GLP-1s a standout option with millions of potential customers in the United States alone.

The American Association for the Advancement of Science named GLP-1 drugs as the scientific breakthrough of 2023, noting that these treatments “are reshaping medicine, popular culture and even global stock markets.”

The success of GLP-1 drugs has amplified investor interest in Big Pharma companies.

As the first company to widely market and distribute GLP-1 drugs, Novo Nordisk has seen its share price leap 137 percent in just two years, from $53 a share in May 2022 to $126 in May 2024. The company also reported sales growth of 36 percent in 2023.

Novo’s market value is now greater than the gross domestic product of Denmark, its home country.

But Eli Lilly, the Indianapolis-based pharmaceutical company and fellow diabetes drug maker, wasn’t far behind. Zepbound, its drug to treat chronic obesity, was approved by the FDA in November 2023.

Revenue for Eli Lilly jumped 25 percent during the first quarter of 2024 compared to the same time last year. It’s now one of the best performing stocks in the S&P 500.

Eli Lilly raised its full-year guidance during its May 1 earnings report, and expects full-year adjusted earnings of $13.50 to $14 per share, up from previous guidance of $12.20 to $12.70 per share.

LLY shares went for about $776 on May 8. The company’s 0.7 percent dividend yield only sweetened the deal for many investors.

Neither company shows signs of slowing. In February, Novo Nordisk announced plans to acquire three manufacturing facilities to meet demand for its blockbuster drugs. Eli Lilly is also racing to increase supply, with seven manufacturing sites either ramping up or under construction.

As shares of Novo Nordisk and Eli Lilly climb, some investors are eyeing other pharmaceutical companies with promising new weight loss drugs in the works.

It’s quickly turning into a crowded field, as investors hope to find an undervalued gem with moonshot potential.

Here are other contenders in the expanding weight-loss drug market.

Shares of biopharmaceutical giant Amgen (AMGN) spiked on May 3 after the company reported positive results from mid-stage trials of its investigational obesity drug, MariTide.

MariTide holds a potential edge over competitors when it comes to user experience: Patients would use a handheld auto-injector just once a month, or possibly even less frequently. This could be a game-changer compared to the weekly injections required by current market leaders, Wegovy (Novo Nordisk) and Zepbound (Eli Lilly).

However, detailed data from that mid-stage trial isn’t expected until the end of the year, and it may take several years for the drug to come to market.

On May 8, shares of Amgen went for $305, up from $230 a share in May 2023.

Viking Therapeutics isn’t currently manufacturing a weight-loss drug, but their lead candidate, VK2809, is in phase two trials.

In addition to its experimental weight-loss injection drug, Viking also plans to start a phase two trial of a once-a-day oral weight-loss tablet later this year.

VKTX has seen significant growth over the last two years. On May 8, shares traded for about $79, up from around $22 two years ago.

VKTX could be an attractive buy for investors seeking a high-risk, high-reward opportunity. The future growth potential for Viking Therapeutics hinges on the success of VK2809. If approved, it could become a major player in the weight management market.

AstraZeneca, a British pharmaceutical company, first tried to develop its own oral GLP-1 drug in-house. The company eventually abandoned the project in favor of licensing an experimental weight-loss pill from a Chinese company called Eccogene in November 2023.

This new drug, which is still in clinical trials,has the potential to cause fewer side effects than current injectable treatments.

AstraZeneca paid $185 million upfront to acquire the drug license, and agreed to shell out up to $1.8 billion more to bankroll future clinical, regulatory and marketing milestones.

The company dropped two other developmental programs, including stage two trials for a sickle cell medication, in order to free up resources for its obesity drug development.

While AstraZeneca is betting big on its newly licensed drug, the product is still in early trials, putting the company at a disadvantage to its competitors. Shares of AstraZeneca went for $76 on May 8 and haven’t budged much in a year.

Investors are bullish about weight-loss drugs and the companies that make them. Analysts see tremendous growth potential, too.

J.P. Morgan Research forecasts that the GLP-1 market will exceed $100 billion by 2030, and total GLP-1 users in the U.S. may number 30 million by the end of the decade — around 9 percent of the overall population.

Meanwhile, Goldman Sachs predicted in February that these new weight-loss drugs could boost the U.S. gross domestic product by 1 percent in the coming years.

It’s impossible to predict which companies will develop the most effective and safest GLP-1 drugs over time, which only adds to investor uncertainty — and excitement — about future earnings.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. Presently, she is the senior investing editor at Bankrate, leading the team’s coverage of all things investments and retirement. Prior to this, Mercedes served as a senior editor at NextAdvisor.

Mortgage rate forecast for May 2024: No break for homebuyers

10 best low-risk investments in May 2024

5 ways to double your money

How to set up an LLC for investments like Series I bonds

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access

BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access

© 2024 Bankrate, LLC. A Red Ventures company. All Rights Reserved.